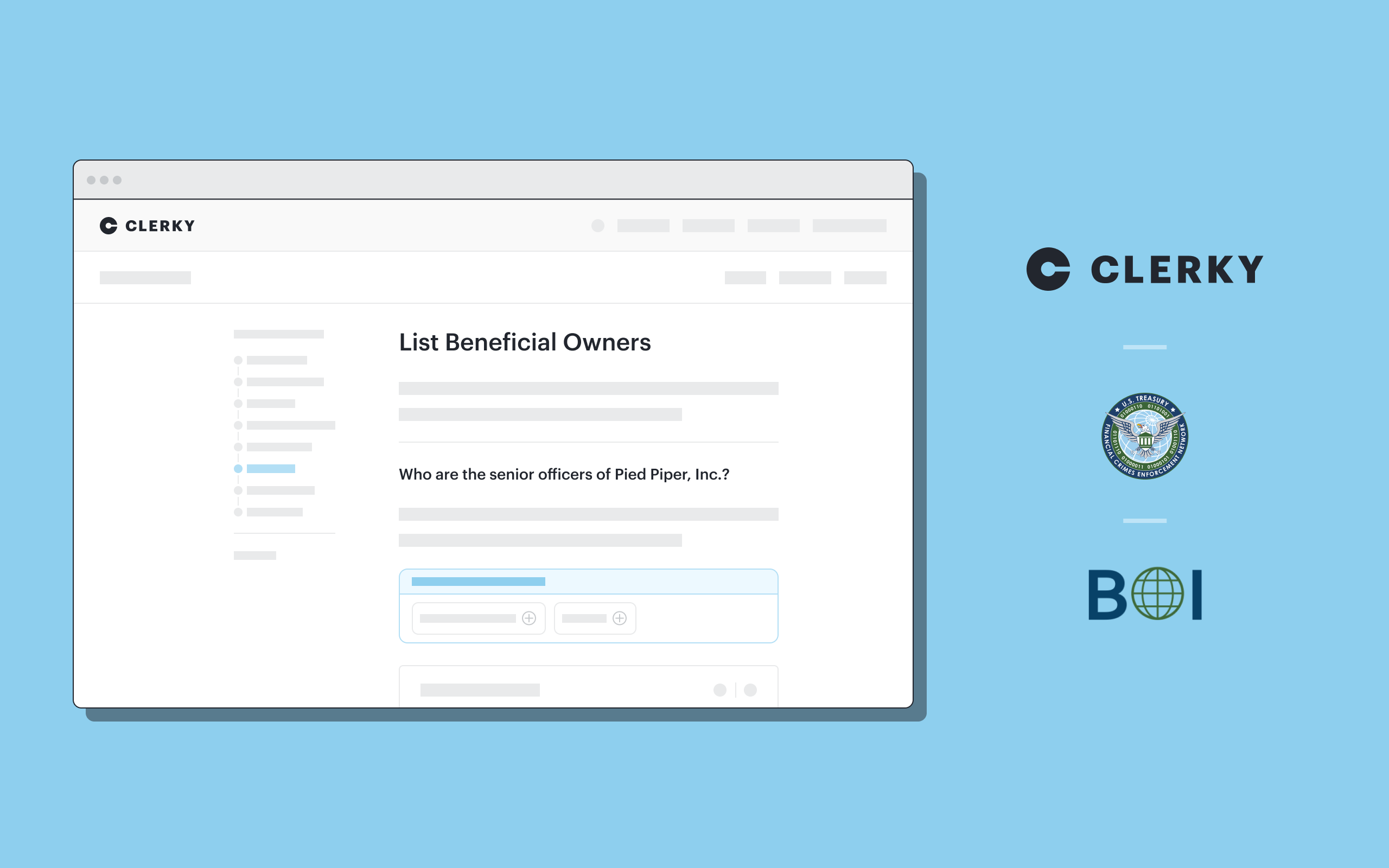

We're thrilled to announce our new BOI reporting tool! You can now submit all your startup's beneficial ownership information to FinCEN without ever leaving Clerky.

In case you hadn't heard, most startups formed in the US now need to submit ownership information to FinCEN, a government bureau that helps detect financial crimes. This new requirement is a consequence of the Corporate Transparency Act (CTA), which went into effect in January 2024.

Most Clerky startups now need to file a BOI report, with limited exceptions. Please refer to the chart below for information about deadlines:

The penalties for failing to file by these deadlines can be severe. That's why we've made staying compliant as easy as possible. As you approach your deadline, we'll send you reminder emails and in-app notifications. We'll also remind you to submit an updated report if we detect that you've changed any of your information, like your startup's name, address, or beneficial owners.

When the time comes to file, you can submit your information directly from Clerky. We'll pre-fill the report with information we already have from your legal paperwork to make things as easy as possible.

It's worth noting that a recent court decision in Alabama found the Corporate Transparency Act unconstitutional. The ruling won't affect most startups, only members of the plaintiffs in that particular lawsuit, but we're closely monitoring the development of any cases that may impact this requirement more broadly.

Do you still have questions about your startup's BOI report? Are you wondering whether you should get a FinCEN ID to make the process easier? You can find answers to these common questions and more in our help center article What is a BOI report?.

What's new in our software:

- Non-US founders can now apply for EINs through Clerky

- Startups can now apply for a Mercury bank account while waiting for their EIN

- We've just launched a cap table integration with Pulley

We've also added new perks, plus a limited-time offer:

- Efficient Capital Labs – 25 basis point discount on ECL's financing fees

- Pulley – 15% off your first year when you sign up through Clerky

- Limited-time offer! Mercury — $1,000 cash for eligible Clerky startups that open a Mercury account (minimum deposit required)

Delaware's Court of Chancery recently ordered that Elon Musk’s $55.8 billion compensation package from Tesla be undone. On the surface, the decision can be confusing since Elon Musk has contributed so much to Tesla. Can a court even get involved with compensation?

Since there's a lot of interest in this ruling, we thought it'd be helpful to provide startup founders with a summary of the legal reasoning behind the outcome. So we read through the entire 200-page opinion to make the outline below for you. Enjoy!

What was the logic of the opinion?

Hopefully this gives you a clear understanding of how the case was decided! We've done our best to distill the opinion down to the essence of its logic. If you want to get into the details, you can read the full opinion on the Delaware Court of Chancery's website.

What are startup attorneys saying?

In case it's helpful, we've put together a list of commentary on this case by well-regarded startup attorneys and law firms:

Subject to any changes that might happen if the case is appealed, the key takeaways from these attorneys and law firms are:

- Make sure that stockholders are given relevant information when having them approve decisions involving conflicts of interest.

- Compensation committees should ideally be comprised of directors that don't have a conflict of interest.

- If compensation for a controlling stockholder is unusually large, it should ideally be negotiated, benchmarked, and in service of company objectives.

None of this is new to competent corporate attorneys, but this case provides a high-profile reminder of how Delaware corporate law works.

These takeaways are more likely to be relevant for large companies like Tesla, because most early-stage startup founders aren't giving themselves above-market compensation. In addition, litigation about compensation is very uncommon with early-stage startups, unless there's a scheme to defraud investors or co-founders. This is in part because litigation can easily kill an early-stage startup, which would be counterproductive for stockholders.

We're excited to announce a new partnership with Pulley, one of the most popular equity management solutions for startups. Thousands of startups use Pulley to create cap tables, secure 409A valuations, and access essential tools for equity management. Pulley is the top-rated cap table solution on G2 and is used by more than 70% of each Y Combinator batch.

Starting today, you'll be able to automatically create a cap table for your startup on Pulley using information from Clerky. Your cap table on Pulley will also automatically update as you issue more shares, stock options, safes, or convertible notes on Clerky.

As a startup attorney, I’ve seen firsthand the challenges startups have with cap table management. Pulley is one of the most popular cap table services with our startups, so we're thrilled to be making it easier for them to get set up on Pulley.

Darby Wong — Co-Founder and CEO of Clerky

In 2011, I was in the same Y Combinator group as Clerky. The founders personally helped me set up my company quickly, saving me thousands on legal fees. I've used Clerky for every company I've started. It's not surprising that Clerky has become the default for so many companies today. I'm excited for Pulley to partner with Clerky and make it easier for more founders to start and scale.

Yin Wu — Co-Founder and CEO of Pulley

To get started, go to the Integrations page for your startup's team on Clerky. Then just go to the Pulley integration and click Install. Once you've connected your Clerky account, Pulley takes care of the rest, syncing your data and setting up your cap table.

That's not all! If you don’t already use Pulley, you'll get 15% off your first year when you sign up through this integration.

We’re excited to work with Pulley to make life even easier for startup founders. This new integration means that Clerky startups will be able to use Pulley's advanced equity management tools without the repetitive data entry. We hope you'll enjoy using it!

We're excited to announce an enhancement to our partnership with Mercury (plus a limited-time offer) that will significantly reduce stress for non-US startup founders — and even some US founders!

If you're a new founder and someone agrees to invest in your startup, you may need to quickly set up a new corporation and open a bank account. Naturally, you want to close the investment as soon as possible. Or maybe you're in a little less of a rush but still need to accept payments or pay employees soon.

Clerky has always made it easy to set up a corporation so you can get the first step done quickly. We've also long partnered with Mercury and others to make that second step, opening a bank account1, as easy as possible. Trusted by more than 100,000 companies, Mercury lays the groundwork for ambitious companies to operate at their highest level with banking and credit cards engineered for the startup journey. With an intelligent banking platform powering their operations, founders and finance teams can efficiently store, manage, and move their funds while driving smarter business decisions. And with access to notable investors, operators, founders, and resources, startups can better navigate the obstacles of company building.

But sometimes startups encounter a roadblock when trying to take this second step. In order to open a US bank account, you generally need to get an EIN from the IRS. If you have a US taxpayer ID, you can probably get an EIN online in just a few minutes. But if you don't have a US taxpayer ID, you'll need to apply by fax. Sometimes you'll need to apply by fax even if you do have a US taxpayer ID. The problem is that the IRS can take months to assign EINs via fax, which means it could take months to open a bank account. That's bad news if you have an investor waiting.

To fix this, we're teaming up with Mercury so you can open a Mercury account while waiting for the IRS to assign your EIN. Clerky startups can now start applying to Mercury through Clerky right after applying for an EIN! This means you can potentially start banking within days of incorporating. No more stressing about when the IRS is going to get back to you. You can now start closing investors, accepting payments, and hiring people in days, not weeks or months.

One more thing — for a limited time, Mercury is helping cover a portion of incorporation costs by offering $1,000 in cash to Clerky startups that open accounts and meet a minimum balance requirement!2 This offer won't last forever, so if you're interested, get started today on Clerky.

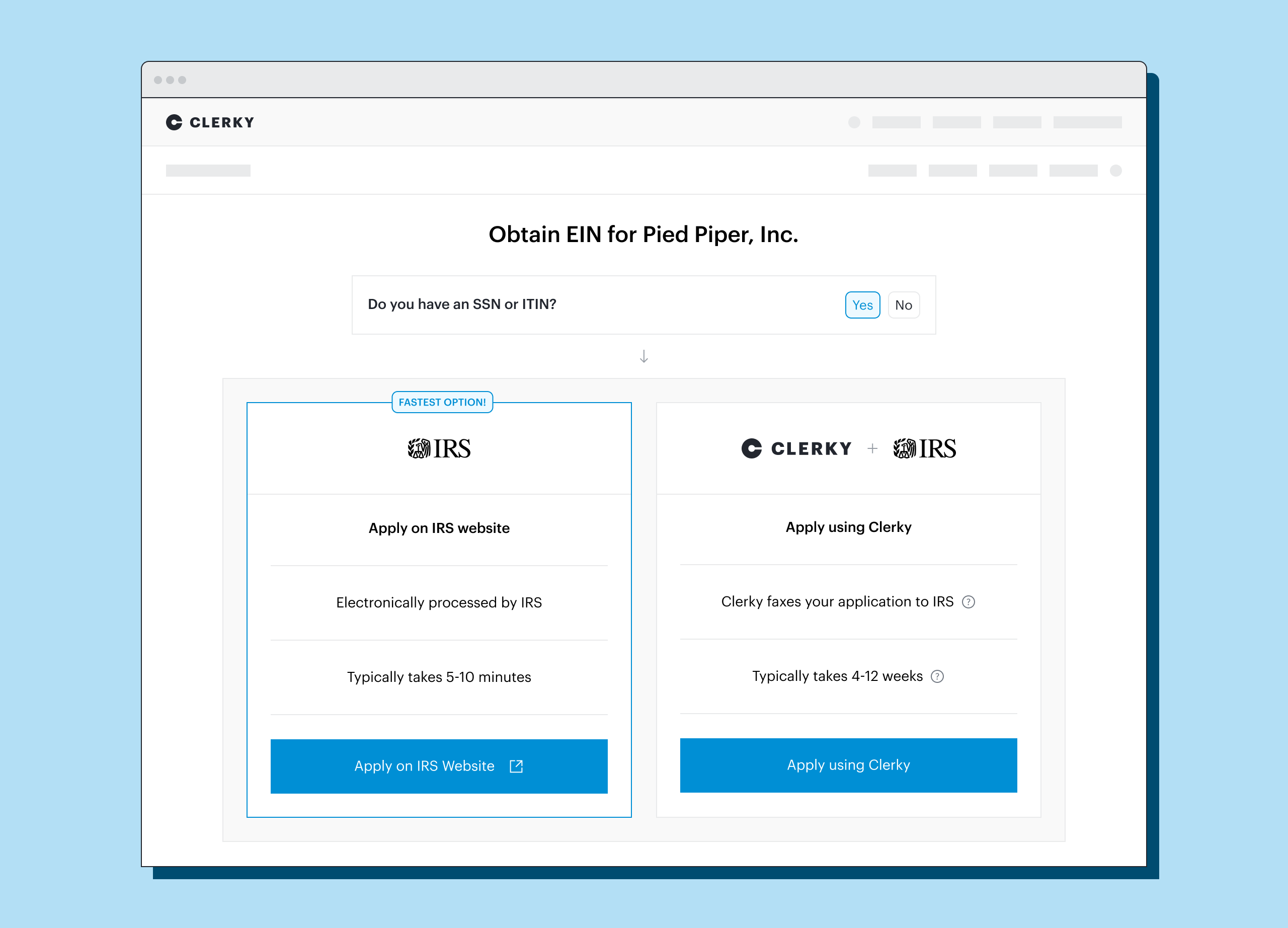

Starting today, non-U.S. founders incorporating on Clerky will be able to apply for an EIN completely online — and for free.

In most cases, U.S.-based startup founders can get an EIN from the IRS website in minutes. Startup founders outside of the U.S. usually can't do this though, because the online application requires an SSN or ITIN. If you incorporate in the U.S. but don't have a personal U.S. taxpayer ID, your only option aside from snail mail is to fax an application to the IRS and wait to receive the EIN back by fax.

Obviously, this is a huge pain. Where do you even find a fax machine these days?

Clerky startups in this situation can now avoid this hassle entirely. Answer a few easy questions to generate the EIN paperwork and have Clerky fax it to the IRS. When we get the EIN back, we'll upload it and notify you immediately. Please keep in mind that the IRS can be very slow to process EIN applications by fax. It can easily take months in some cases. Unfortunately, there's no way to speed this up (believe us, we've looked).

We're especially proud of our new EIN functionality because it's 100% in-house, not outsourced. Even though it's very common to outsource handling EIN applications, we decided to do the work ourselves in order to minimize the risk of delays or data breaches. We've also worked hard to make sure that you can fully comply with IRS instructions when you submit an EIN application through Clerky. Surprisingly, this isn't the case with a lot of other services that help startups with EINs.

If you're incorporating a startup and don't have an SSN or ITIN, we hope you'll enjoy this new feature. We look forward to making your life easier!

.png)